The Saver’s Credit, an IRS Retirement Savings Contributions Tax Credit, allows eligible taxpayers to receive a tax credit for contributions made to an IRA, employer-sponsored retirement plan, or an ABLE account. Individuals can qualify for a maximum credit of $1,000 ($2,000 for married couples filing jointly) based on contributions of up to $2,000 ($4,000 if married).

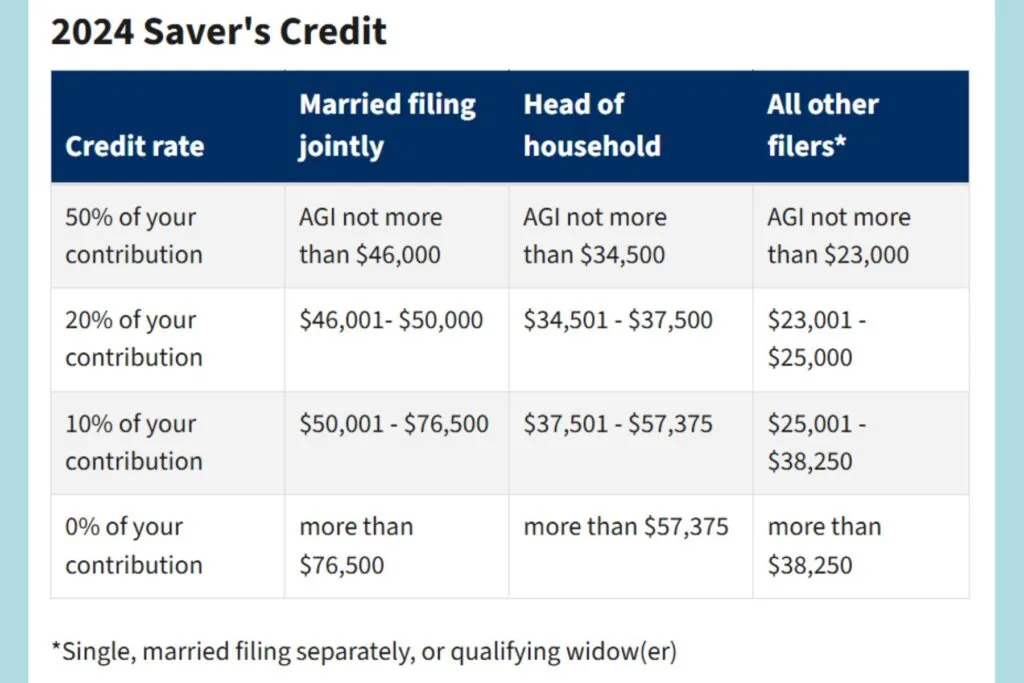

Eligibility criteria include being at least 18 years old, not being claimed as a dependent, and not being a full-time student. Specific income limits apply: married couples filing jointly can earn up to $76,500; heads of household, up to $57,375; and singles or married individuals filing separately, up to $38,250. Qualified surviving spouses are also eligible.

To determine eligibility and calculate the potential credit, taxpayers can utilize the IRS’s Interactive Tax Assistant. Additional resources and information about the Saver’s Credit can be found on the IRS website.